- Home

- Views On News

- Feb 14, 2023 - What India's Best Stocks Look Like: The 11 Stocks You Must Own

What India's Best Stocks Look Like: The 11 Stocks You Must Own

For the past few years, Adani group stocks have caught the fancy of the markets.

Shockingly, of the total gain in market cap of all listed Indian stocks in 2022, 79% was registered only in Adani's listed companies!

As stock prices of the group's 7 listed companies soared from one high to the next, over time, even sceptics converted into believers, loading up their portfolios with the group's shares.

In recent weeks, the colossal loss in valuations have shocked investors as they watched multiyear gains evaporate within a few trading sessions.

But most seasoned investors were unaffected as they had little or no exposure to the group.

After all, this was not their first dance...

Over the decades, the markets have seen numerous businessmen and their groups catapult into the limelight only to fade away or fall on the side-lines equally soon.

And while it would be too soon to write an obituary for the Adani group, one thing is for certain...

Businesses come and go, trends change with time and market darlings often become laggards, but there will always be some companies that seem to just go on and on and on.

In the age of constant buy-outs, mergers, and bankruptcies, it would seem like there is no such thing as a brand anymore.

But of course, there is! There are companies that have survived crises, reinvented themselves, worked harder than ever and thrived.

In this ever-changing world, where preferences change faster than ever before, long term investors value something more constant.

Because long term investors choose to stick with businesses that make sense, not this year or the next but over the long run, rather than trying to chase performance for a couple of quarters.

It's natural for companies to wax and wane in size, of course. One-time stalwarts fall out of favour or their businesses succumb to changing consumer and business trends.

If being in the BSE 30 is a sign a company has made it to blue-chip status, then being kicked out of it may be a sign that the world has moved on.

But by and large, what truly gets the world's best investors excited are shares of companies that are slightly more expensive but offer exposure to exceptional businesses.

These are companies with high-quality operations, strong growth prospects and solid share-price momentum.

For this article, we looked at data from over 50 blue-chip stocks and crunched some numbers to identify and understand what makes these stocks eternally popular.

Based on this exercise, we derived a list of 11 best stocks meeting all of these characteristics that one can hold now and forever.

Equity Investing Doesn't Always have to be Exciting

New investors often make a mistake in believing that the stock market is an exciting place, where millions of rupees can be made in a short span of time.

In reality, investing in stocks over the long term is incredibly boring and often involves hard work. It is not as exciting as many think it is.

If someone is looking for excitement, one can speculate in the derivatives market, buy a lottery, or place a bet in a casino.

If you were to ask a newbie investor what kind of annual return he expects from the stock market, more often than not, he would probably say 30%, 50% or even more!

After all, if he is to take a "risk" with his capital and choose to invest in equity instead of a fixed deposit, then the return must be high enough to take that risk.

This is because investors(especially inexperienced ones) are loss averse, not risk averse, which makes them choose "exciting" stocks.

But seasoned investors are happy earning a reasonable return, as long as their capital is safe and their wealth grows consistently over time.

According to conventional wisdom, an annual return of investment (ROI) of approximately 10% to 12% or greater is considered a good ROI for an investment in good quality stocks.

Now, one might say 12% is boring but if you think about it, over a time horizon of say 25 to 30 years this could generate significant wealth for an investor.

For instance, an investment of Rs 2 million (m) at a CAGR of 12% would grow to Rs 60 m over 30 years.

While 12% may seem boring, an amount of Rs 60 m is anything but boring!

Hence, instead of trying to find the next big thing or spot market trends, an investor could be better off simply by investing a significant portion of their corpus in the best of the best stocks and watch them grow.

If you still crave returns of 20%, 50%, 200% and more, look elsewhere.

While one cannot compare stocks to fixed deposits as they do not promise a fixed return, over the years, these stocks have consistently been able to provide safe and reasonable returns to investors.

And the returns along with dividends received from such stocks have a track record of persistently beating fixed deposit rates.

But what are the characteristics of these forever stocks? And what are the parameters on the basis of which, one can evaluate them?

Well, sit back and relax. We have done the groundwork for you. Here are the 11 best stocks* of India based on a series of defined characteristics and why!

* The list of stocks derived is based on the use of certain parameters used by the writer for this specific exercise. There is no buy/sell/hold view on any of the stocks. These should not be considered as recommendations on any stock.

Readers may define their own parameters and characteristics to arrive at their own conclusion.

# Long Term or Forever

Billionaire investor Warren Buffett has said that when owning stocks in well-managed businesses, his "favourite holding period is forever."

Forever is an exceptionally long time, even for a long-term investor like Buffett, but his statement makes absolute sense. No wonder, he is viewed as one of the most successful investors in history.

If you can identify a business, that never goes out of fashion, then buy it and hold on to it forever.

When it comes to certain businesses, they may change in specific form but the business or service as a whole rarely goes out of fashion. Demand patterns for such stocks do not have an element of cyclicality.

Such stocks may be viewed as boring but tend to be less volatile and also manage to protect price and returns during tough times due to their stable nature.

Their USP? Staying relevant. These companies are always slightly ahead of their time, and well ahead of their competition.

Hindustan Unilever Limited (HUL) is a classic example.

For instance, with over 85 years of heritage in India, HUL is India's largest fast-moving consumer goods company. On any given day, nine out of ten Indian households use its products.

Imagine, HUL going out of business any time soon... Highly unlikely, right?

Hence, the first characteristic of our best stocks list is being in a business that never goes out of 'business.'

These stocks may not be the "hottest" names out there, but have a high chance of delivering steady growth over many decades and beyond.

# Growing, Ever Forward!

The stocks that make it on to our coveted list have impressive growth credentials.

In terms of historic growth, our companies have been impressive on the top line as well as on the bottom line thanks to rising profitability.

Businesses that can grow consistently for long periods tend to be rewarded by the market, delivering handsome returns to shareholders in the process.

Our list of stocks comprises of leaders in their respective industries having reached massive size and scale.

Hence, while some might call them "mature firms" or "seniors," these companies tend to produce higher growth than most mature companies given their industries and loyal client base.

While these companies may not experience significant growth, nevertheless they continue to grow and expand their operations year after year.

Inexperienced investors often get blindsided by being fixated on only revenue growth.

However, sales growth can be potentially misleading about the strength of a business because growing sales for money-losing businesses can be harmful if a company is unable to reach profitability.

For instance, sales grew at a CAGR of 4.5% over the last decade for Adani Enterprises from Rs 464 billion (bn) in 2013 to Rs 694 bn in the financial year ended March 2022.

But if you consider profits for the same period, there was a decline of 52% from Rs 16 bn to Rs 7.7 bn.

The median 10-year CAGR of sales and net profit is 11.9% and 11.8% respectively for BSE 30 stocks.

Our chosen 11 are close to this median figure with an average CAGR for sales coming in at 11.2% and average CAGR for net profit at 12.3%

It is important to note that even though these companies might report weak numbers for a few quarters, they always seem to find a way to transform themselves and be back on the saddle again.

Take the case of Mahindra & Mahindra, one of our picks. Between 2019 to 2021, the company reported a sharp decline in revenue.

However, the company quickly realigned itself by consolidating its businesses and cutting out all its loss-making ventures.

Simply put, the groups missteps which shrank its turnover, thereby dragging down group profits over the last few years has been almost totally rectified.

With this, the return on equity (ROE) increased from 4.4% in F21 to over 18% and revenue jumped 21% in FY22.

# Quality ✓ ✓ ✓

While growth is a valuable metric for investors when analysing a company, it doesn't matter much if a company's operations are not of superior quality.

If the return on capital spent to achieve growth is less than the cost of the capital used, EPS growth reduces rather than increases shareholder value.

No such worries for most of our stocks though as their measures of business quality pass the test.

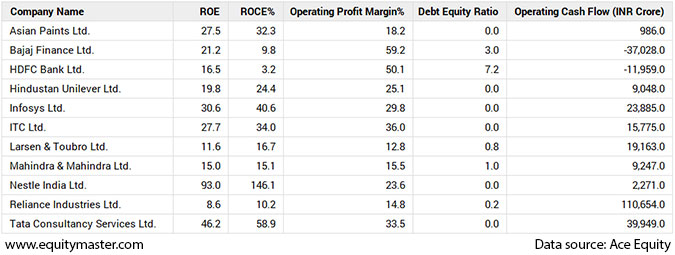

The average return on capital employed (ROCE) for our stocks stands at 35.6% and return on equity (ROE) comes in at 28.9%

Operating profit margins are also noteworthy at an average of 29% for the last financial year.

Finally, all of these companies have reported healthy Operating Cash Flows (OCF).

OCF is the lifeblood of a company and arguably the most important barometer that investors have for judging corporate well-being.

If you are wondering why HDFC Bank and Bajaj Finance have a negative OCF, here's why...

Banks primarily profit through lending, that's money going out- an outflow but borrowers do not repay the full sum(inflow) at one go. Rather, they typically pay back smaller portions (installments) over time.

Hence, outflow will tend to be more than inflow, which makes it negative.

Consequently, it's logical that well-performing banks and NBFC's have negative operating cash flows due to increased lending which indicates that people are borrowing from these banks and in turn the banks will profit.

Again, some of you might be perplexed as to how the debt-to-equity ratio is so much higher for both HDFC Bank and Bajaj Finance as compared to the other companies on our list.

Well, that's simply because banks and NBFC's tend to have higher D/E ratios because they borrow capital in order to lend to customers.

# Up, Up and Away

While you might be happy that you own shares in a great company, it wouldn't matter much if no one else agrees with your reasoning and the share price is left to languish.

For stocks to qualify on our list, we decided to check how the market perceives them.

As most of our 11 elite stocks are household names, share price momentum suggests they have plenty of fans as well.

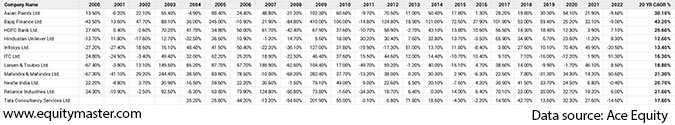

The average CAGR for our list of 11 stocks over the last 20 years is an impressive 22%.

The best performing stock over the last two decades is Bajaj Finance having reported a CAGR of 43% while even the lowest performing stock, Hindustan Unilever has an impressive CAGR of 12.6%

# Staying Relevant!

Business today is characterized by relentless change. Which is why companies on our list continually evolve to stay relevant, innovative, and competitive.

The difference between great companies and the greatest companies is that great companies are really good at doing particular things while the greatest companies are really good at learning how to do new things.

A characteristic that stands out for our cherry-picked companies is that they are quick to read and act on signals of change.

These companies have worked out how to experiment rapidly, frequently, and economically-not only with products and services but also with business models, processes, and strategies.

They have built up skills in managing complex multistakeholder systems in an increasingly interconnected world.

Perhaps most important, they have learned to unlock their greatest resources-the people who work for them.

Growth can be defined as an increase in the scope of activities or renewal of capabilities. Usually, a good reason for growth is to become more competitive.

For our chosen 11 companies, every time, the core business has been under threat or these firms have reached the limits of their natural market, they have gone on to stretch and grow.

Or perhaps, the company's existing resources weren't being used effectively which lead to alliances-based activity that brought access to new technology and new people.

Our companies have never succumbed to pressure from their investors to grow for growth's sake. As this would lead them to seek results at any cost, resulting in aggressive and often expensive acquisitions. We know that 70% of acquisitions fail.

Take the case of Nestle India. While looking at the company's growth over the last 10 years, one might feel that is has been unremarkable at a CAGR of just 6.5%.

But if we were to break this up into two periods, the picture looks a whole lot better.

Between 2012 and 2017, Nestle's sales grew at a CAGR of just 3.7% but between 2017 and 2021, the growth has improved to 10.1%

So, what did the company do to achieve this?

You guessed it right! Adapt and evolve to stay relevant once more.

Since 2016, Nestle adopted a growth-led strategy that involves frequent launches to expand its portfolio and going deeper into untapped markets.

Traditionally an urban-centric company, Nestle begun pushing the throttle on rural expansion in late 2017.

The scale-up has been impressive. From 1,000 villages in 2017, Nestle now places its products directly in almost 100,000 villages. It aims to expand to 200,000 rural habitats within the next few years.

Nestle has accelerated an investment plan of Rs 50 bn till 2025 to grow its India business faster.

By the looks of it, the pace of growth appears unlikely to slow down in the future.

# Icing on the Cake

Have you ever eaten a heavy meal and feel that you will explode if were to eat anymore?

And just then someone brings out a cake and you find yourself reaching out to grab a slice...

Well, it's not just you, that's human nature. Everyone wants more of the good thing.

While our 11 companies have a track record of providing reasonable returns for investors, there is something else they do to keep keeps investors excited!

Over the years, all of these companies have rewarded investors with a whole bunch of extra goodies.

Be it bonus issues, stock splits, buy backs or hefty dividends, these companies have gone the extra mile to keep their shareholders happy.

L&T has rewarded investors with a mind boggling 10 bonuses over the last 7 decades.

ITC and Mahindra & Mahindra aren't far behind with 7 and 6 bonus issues respectively.

8 of our 11 companies have split their stocks as well. And if we look at dividend history for the last decade, all the stocks have paid healthy dividends to their shareholders.

The average dividend as a percentage of face value for our stocks is at over 1,150% with the highest numbers coming in from TCS and the lowest from Reliance Industries over the last decade.

In Conclusion

So, there you have it. From the perspective of a series of characteristics, these are the 11 best stocks* that one must aspire to own.

Even high-risk investors must consider owning these stocks to diversify their investments. Since these stocks are relatively stable and provide regular dividends, they can help one meet their long-term financial goals with ease.

As an investor, you can make a fair estimation of how the prices of these stocks will move in the long term, hence allowing you to plan your financial goals.

* The list of stocks derived is based on the use of certain parameters used by the writer for this specific exercise. There is no buy/sell/hold view on any of the stocks. These should not be considered as recommendations on any stock.

Readers may define their own parameters and characteristics to arrive at their own conclusion.

Safe Stocks to Ride India's Lithium Megatrend

Lithium is the new oil. It is the key component of electric batteries.

There is a huge demand for electric batteries coming from the EV industry, large data centres, telecom companies, railways, power grid companies, and many other places.

So, in the coming years and decades, we could possibly see a sharp rally in the stocks of electric battery making companies.

If you're an investor, then you simply cannot ignore this opportunity.

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.comDisclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

Yazad Pavri

Cool Dad, Biker Boy, Terrible Dancer, Financial writer

I am a Batman fan who also does some financial writing in that order. Traded in my first stock in my pre-teen years, got an IIM tag if that matters, spent 15 years running my own NBFC and now here I am... Writing is my passion. Also, other than writing, I'm completely unemployable!

Equitymaster requests your view! Post a comment on "What India's Best Stocks Look Like: The 11 Stocks You Must Own". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!